Welcome to our AML News and Updates Newsletter November 2024 edition. 👏

Stay up to date with main AML news and updates in less than 10 minutes per month!

This newsletter is brought to you by my newly re-branded and re-designed website: www.amlcube.com which aims to become your go-to resource for all anti-financial crime developments (without the limitations imposed by the LinkedIn algorithm)!

You can access it here! Bookmark it so you can access new content whenever you want!

BUT FIRST - do not miss! 3 days until my 90-min crash course at an exclusive price!

For those who are last-minute, here are the details of the 90-min crash course:

𝗧𝗼𝗽𝗶𝗰: 𝗠𝗼𝗻𝗲𝘆 𝗟𝗮𝘂𝗻𝗱𝗲𝗿𝗶𝗻𝗴 𝗶𝗻 2025: 𝗔𝗹𝗹 𝗬𝗼𝘂 𝗡𝗲𝗲𝗱 𝘁𝗼 𝗞𝗻𝗼𝘄

𝗗𝗮𝘁𝗲: 𝗧𝗵𝘂𝗿𝘀𝗱𝗮𝘆, 𝗡𝗼𝘃𝗲𝗺𝗯𝗲𝗿 14, 2024

𝗧𝗶𝗺𝗲: 11:00 𝗮𝗺–12:30 𝗽𝗺 𝗘𝗘𝗧 / 9:00 𝗮𝗺–10:30 𝗮𝗺 𝗕𝗦𝗧 / 1:00 𝗽𝗺–2:00 𝗽𝗺 𝗚𝗦𝗧

𝗖𝗼𝘀𝘁: €37

Optional: Join a 30-minute networking session afterward!

Don’t miss this chance to support my work, connect directly and ask me anything about AML!

Now to our Newsletter:

Let's see an outline of the topics to be covered in this edition:

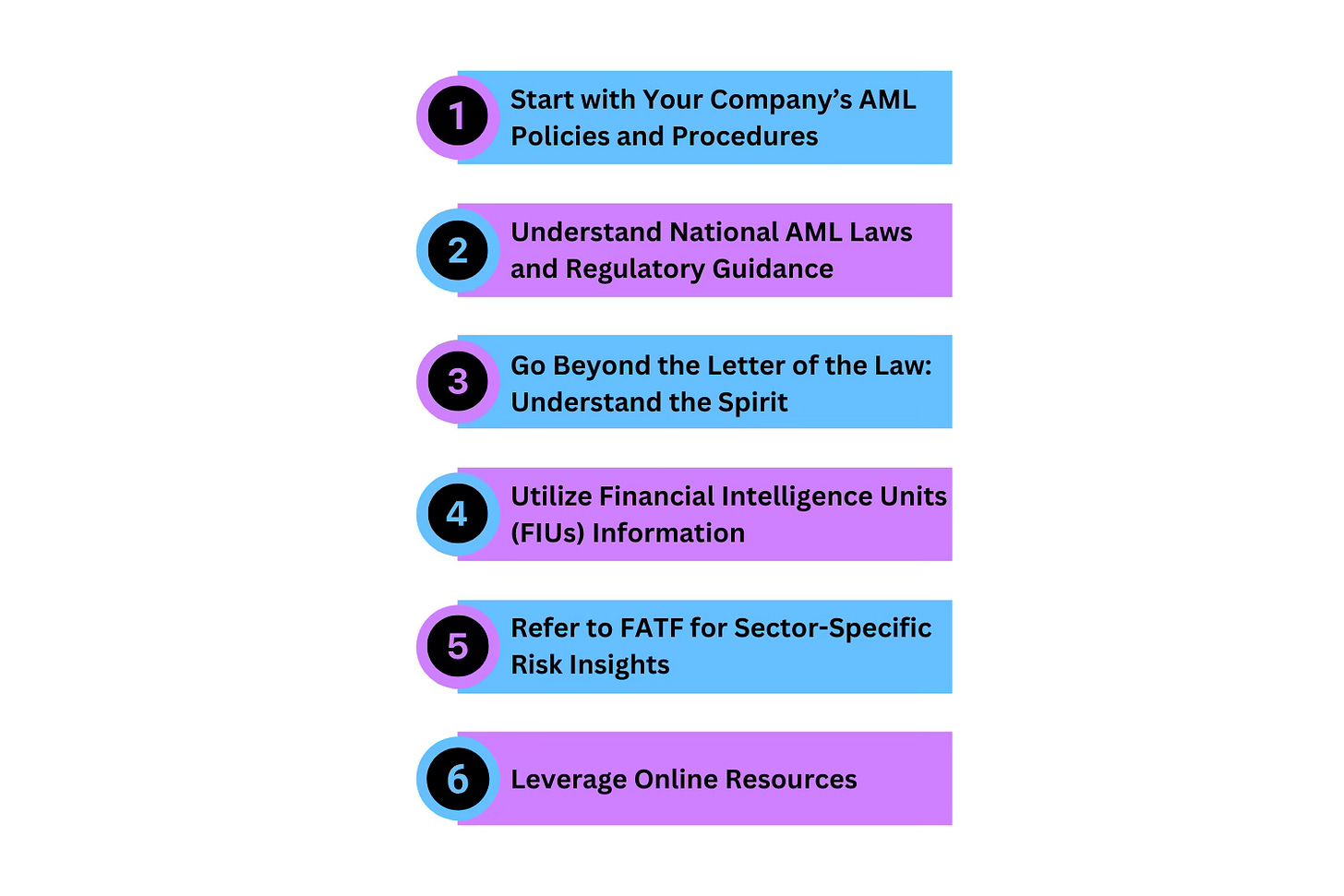

Discussion of the month: 6 Steps to Build Your AML Knowledge: A Guide for Compliance Professionals

Regulatory Developments:

The FATF has published a document outlining its procedures for conducting mutual evaluations and more.

The EU extended sanctions against 25 individuals and 3 entities involved in chemical weapons proliferation.

FinCEN has issued an alert to financial institutions about Hizballah.

Singapore Publishes National Anti-Money Laundering Strategy.

Outcomes of the FATF Plenary Meeting 23-25th October 2024 - Paris.

3. Other News:

TD Bank hit with record $3 billion fine over drug cartel money laundering

Tigran Gambaryan, the head of financial crime compliance at Binance, has been released from detention in Nigeria

EPPO uncovers Chinese underground banking network suspected of €113 million VAT fraud

6 Steps to Build Your AML Knowledge: A Guide for Compliance Professionals

Building a solid understanding of Anti-Money Laundering (AML) is essential for anyone entering or progressing in compliance. Although some certifications provide dedicated knowledge, not everyone can afford them. The good news is that many reliable resources are available at no cost, offering accessible ways to deepen your knowledge. And honestly, this is what I did when I started.

Here are key steps and resources to help you advance your AML knowledge effectively.

1. Start with Your Company’s AML Policies and Procedures

Every regulated company is required by law to have AML policies and procedures tailored to its risk profile and operational structure. This should be your first point of reference. These internal documents define expectations, responsibilities, and standard procedures to combat financial crime within your company. Studying them carefully will ground you in the foundational AML practices you’ll encounter every day. Even if you are working in another department of a regulated entity, the AML policies and procedures must be available to all employees so, you must be in a position to access them.

How This Helps: By understanding your organization’s specific AML requirements, you gain direct insights into how AML laws and guidelines are implemented in practice and within your organization.

2. Understand National AML Laws and Regulatory Guidance

Familiarize yourself with your country’s AML laws, which establish the legal framework for combating money laundering and terrorism financing. National AML regulations specify the obligations of financial institutions and regulated entities, including due diligence, reporting, and record-keeping requirements.

In addition to national laws, refer to specific guidance provided by the regulator. Regulatory bodies often release advisories, FAQs, and guidance to clarify complex areas of AML law and highlight areas where financial institutions should exercise caution.

How This Helps: You gain context for the laws and regulations governing AML practices, helping you apply these principles correctly in your work.

3. Go Beyond the Letter of the Law: Understand the Spirit

A critical aspect of effective AML work is understanding not only the "letter of the law" but also its "spirit." AML laws are designed to safeguard the financial system from misuse, protect vulnerable sectors, and ensure that financial institutions fulfill their role in crime prevention. Adopt this mindset to focus on the intent behind AML measures—identifying and stopping criminal abuse of the financial system.

How This Helps: By understanding the purpose of these rules, you can approach AML tasks with the level of scrutiny regulators expect and ensure compliance that’s proactive, not just a checkbox exercise.

4. Utilize Financial Intelligence Units (FIUs) Information

Financial Intelligence Units (FIUs) in each country often provide useful resources, including trends, typologies, and case studies on financial crime. These insights are invaluable for professionals looking to align their AML work with current criminal tactics and regulatory expectations. FIUs also often publish statistics on suspicious activity reporting and trends in money laundering, helping professionals stay informed on where threats are most concentrated.

How This Helps: Reviewing FIU reports can deepen your understanding of emerging risks, common red flags, and industry-specific vulnerabilities.

5. Refer to FATF for Sector-Specific Risk Insights

The Financial Action Task Force (FATF) provides valuable resources on AML and financial crimes. FATF reports offer information on the vulnerabilities faced by various industries, from banking to real estate, helping AML professionals understand where their risks lie. Visit https://www.fatf-gafi.org/en/home.html

How This Helps: Reviewing these FATF documents can support your knowledge of risk factors associated with specific sectors, equipping you to approach AML processes with greater accuracy and industry insight.

6. Leverage Online Resources

Online resources can play a significant role in keeping you current with the AML landscape, as they often provide real-time updates on regulatory changes, enforcement actions, and emerging trends. Reliable websites and industry publications—such as regulatory agency websites, AML-focused blogs, and professional forums—offer insights into real-world challenges and the latest methodologies in money laundering and financial crime prevention.

For concise and up-to-date content tailored to AML professionals, visit my newly re-designed and re-branded website, where I regularly publish actionable insights and guidance. You can access it here: www.amlcube.com

How This Helps: Online resources can help you stay up to date with regulatory developments and anti-financial crime trends while saving you time.

A Big “BUT”

While free resources are a critical foundation, employers in AML prioritize practical experience. Gaining experience, especially in a regulated entity, offers exposure to real-world AML processes and challenges that simply cannot be replicated through coursework or study alone. Focus on securing hands-on experience, such as assisting with KYC, customer due diligence, or transaction monitoring within your company. Practical exposure to these functions will enable you to apply your theoretical knowledge in ways that align with industry expectations.

Use these free resources to build your AML foundation, but remember that practical experience remains indispensable in building a career in AML. Prioritize gaining both knowledge and practical insights to advance confidently in the field.

The FATF has published a document outlining its procedures for conducting mutual evaluations and more.

The FATF has published a document outlining its procedures for conducting mutual evaluations, follow-up monitoring, and identifying countries with strategic deficiencies in AML/CFT/CPF. The assessment is based on the time since a country's last assessment, its level of ML/TF risks, and the relative size of its economy and financial sector. After their mutual evaluation, countries have three years to take action and address the deficiencies. If they fail to do so, they will face a range of measures, including public identification.

The EU extended sanctions against 25 individuals and 3 entities involved in chemical weapons proliferation

The sanctions will be valid for an additional year, until 16 October 2025. These sanctions include asset freezes, travel bans, and restrictions on financial transactions. The goal is to combat the use and spread of chemical weapons and support international efforts to ban them.

FinCEN has issued an alert to financial institutions about Hizballah

The purpose of the alert is to raise awareness about the risks of Hizballah financing and providing guidance on how to identify and report suspicious activity. Recognizing the ongoing threat posed by Hizballah, a U.S.-designated Foreign Terrorist Organization, FinCEN aims to help disrupt the group's ability to fund its terrorist activities through illicit means. The alert provides detailed information on Hizballah's financing methods, suspicious activity indicators, and best practices for financial institutions to follow.

Singapore Publishes National Anti-Money Laundering Strategy

On October 30, 2024, Singapore released its National Anti-Money Laundering (AML) Strategy, reinforcing its commitment to an effective AML framework amid evolving financial crimes. The National AML Strategy is structured around three primary pillars: Prevent, Detect and Enforce. These pillars are supported by a coordinated framework that includes: Whole-of-Society Coordination, Legal and Regulatory Infrastructure, and International Cooperation.

Outcomes of the FATF Plenary Meeting 23-25th October 2024 - Paris

The third 2024 FATF Plenary meeting took place in Paris between 23rd-25th October 2024. Delegates from more than 200 jurisdictions attended.

Read a breakdown of the most significant outcomes here.

TD Bank hit with record $3 billion fine over drug cartel money laundering

CNN: TD Bank will pay a $1.3 billion penalty that will be paid to the US Treasury Department’s FinCEN and $1.8 billion to the US Justice Department for violating the Bank Secrecy Act (BSA). The bank “made its services convenient for criminals” and enabled three money laundering networks to tranfer more than $670 million through the bank. The bank “prioritized growth and profit” over compliance and enabled drug trafficking. More details in the article.

Tigran Gambaryan, the head of financial crime compliance at Binance, has been released from detention in Nigeria

Tigran Gambaryan has been released after the government dropped money laundering charges against him. His release comes after eight months of legal battles, during which he faced accusations alongside Binance with laundering more than $35 million. The prosecutor stated that the case had more to do with Binance Holdings Limited, Gambaryan's employer, than with him personally. Binance is still facing charges for money laundering and tax evasion.

EPPO uncovers Chinese underground banking network suspected of €113 million VAT fraud

According to EPPO: “The investigation identified a complex scheme of international tax fraud, carried out through numerous ghost companies (“missing traders”), which imported hundreds of containers of clothing and accessories from China to Italy, using triangulations with Bulgaria and Greece, to hide the origin of the goods. It is understood that the criminal scheme had a turnover of at least €500 million, while evading the payment of VAT and custom duties.”

Found this Newsletter useful?

Share it with other people to spread awareness!

Have a nice rest of the month!

Regards

Anna Stylianou

Founder AML Cube Consulting and Education